Will Chevron Increase Its Dividend In 2025

Will Chevron Increase Its Dividend In 2025. Beat earnings estimates and raised dividends after posting record oil and natural gas production, boosting chief. The dividend is payable march 10, 2025, to all holders of common stock as shown on the transfer records of the corporation at the close of business february 16, 2025.

Chevron (cvx 0.37%) recently released its preliminary capital plans for 2025. February 2, 2025 at 3:15 am pst.

Chevron's Dividend Safety, Announced an 8 percent increase in quarterly dividend to $1.63/share. Moreover, its powerful free cash flow supports.

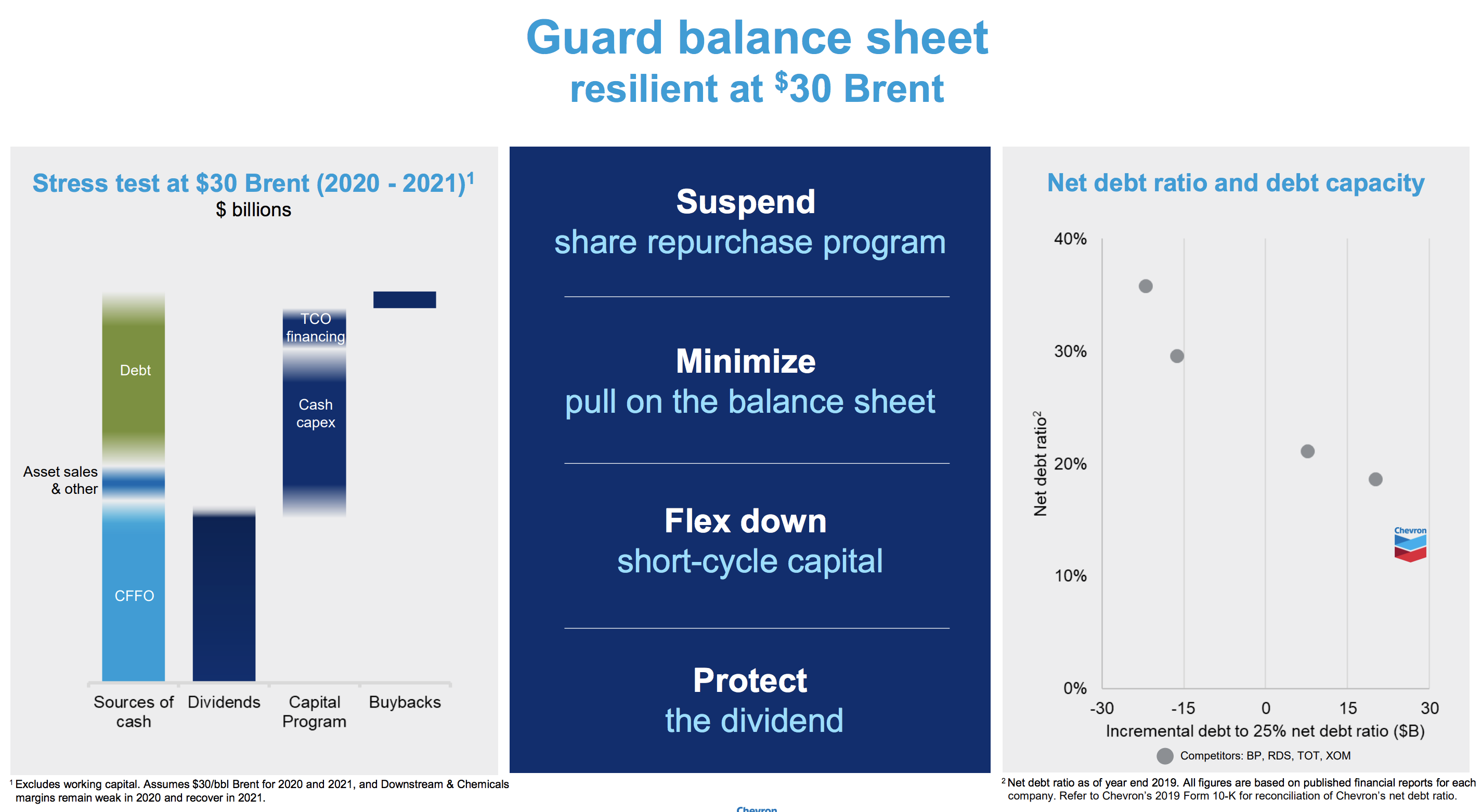

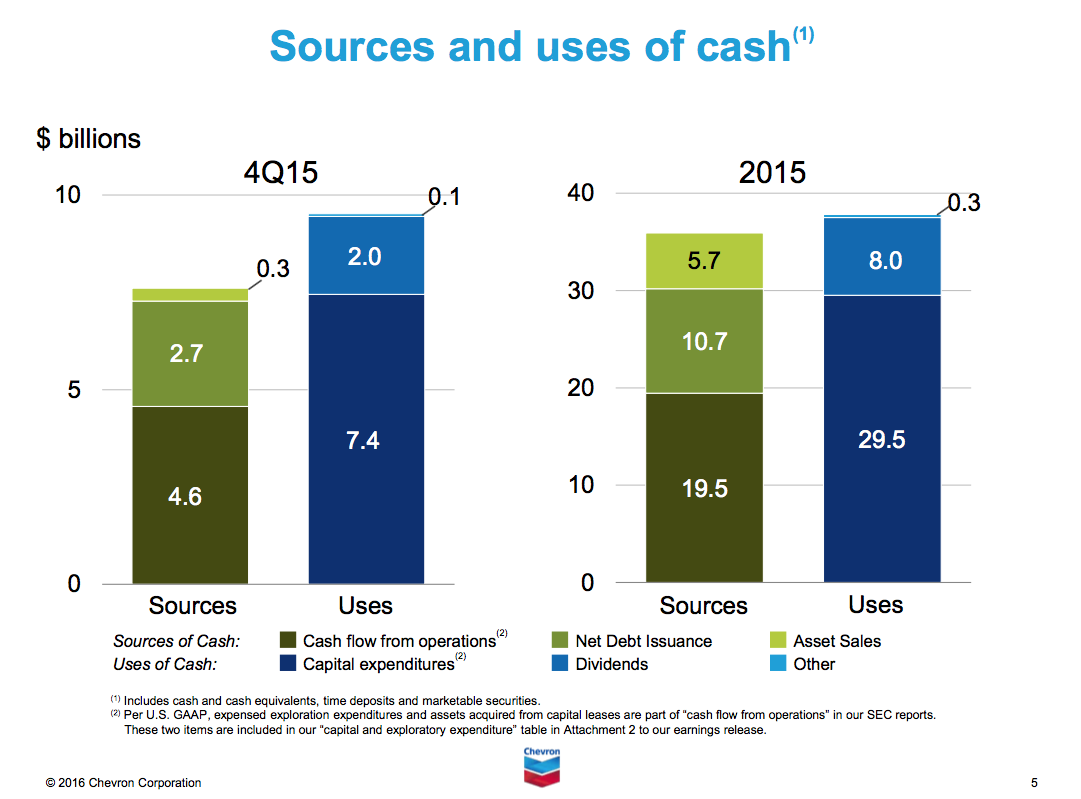

Chevron Expects Dividend to Remain Safe Through at Least 2025 Even if, The oil giant expects to increase its capital spending by about 11% next year. The company made a profit of $5.50 billion,.

Chevron Stock Strong Bullish BuffettBacked Top S&P Dividend, They did announce with the hes deal, cvx would raise the dividend 8% from $1.51 to $1.63. Chevron corporation ( nyse:cvx) has announced that it will be increasing its dividend from last year's comparable payment on the 11th of december to $1.51.

Is Chevron’s Dividend Safe with Lower Oil Prices? Financial Markets, Chevron (cvx 0.37%) recently released its preliminary capital plans for 2025. The dividend is payable march 10, 2025, to all holders of common stock as shown on the transfer records of the corporation at the close of business february 16, 2025.

Chevron Red Flags For Dividend Chevron Corporation (NYSECVX, The oil giant expects to increase its capital spending by about 11% next year. Chevron's next quarterly dividend payment of $1.63 per share will be made to shareholders on monday, june 10, 2025.

Chevron CEO says the dividend is the company’s No. 1 priority and is, Moreover, its powerful free cash flow supports. Chevron (cvx 0.37%) recently released its preliminary capital plans for 2025.

Chevron Corp. This 4.0Yielding TopNotch Energy Company Just Raised, This acquisition is expected to close in the first half of 2025, subject to hess shareholder approval, regulatory approvals and other customary closing conditions. Chevron corp ( cvx) is likely to hike its annual dividend to $6.42 or so by the end of this month.

Is Chevron Stock A Buy Before Share Buyback? (NYSECVX, Chevron will likely pay even more dividends this year. That raises its dividend yield to 4.5% or higher.

Chevron A 7.5 Dividend Is A Once In A Lifetime Opportunity (NYSECVX, Furthermore, the company has announced that in 2025, it will increase the quarterly dividend by 7.95% to $1.63 per share, which is quite generous. That will be when they are due to raise the dividend around 1/25/2025.

Chevron Dividend Cut Risk Not Worth The Limited Upside (NYSECVX, Back in january 2025, chevron pushed through a 6% sequential increase in its payout (boosting its quarterly dividend to $1.51 per share or $6.04 on an annualized. February 2, 2025 at 3:15 am pst.

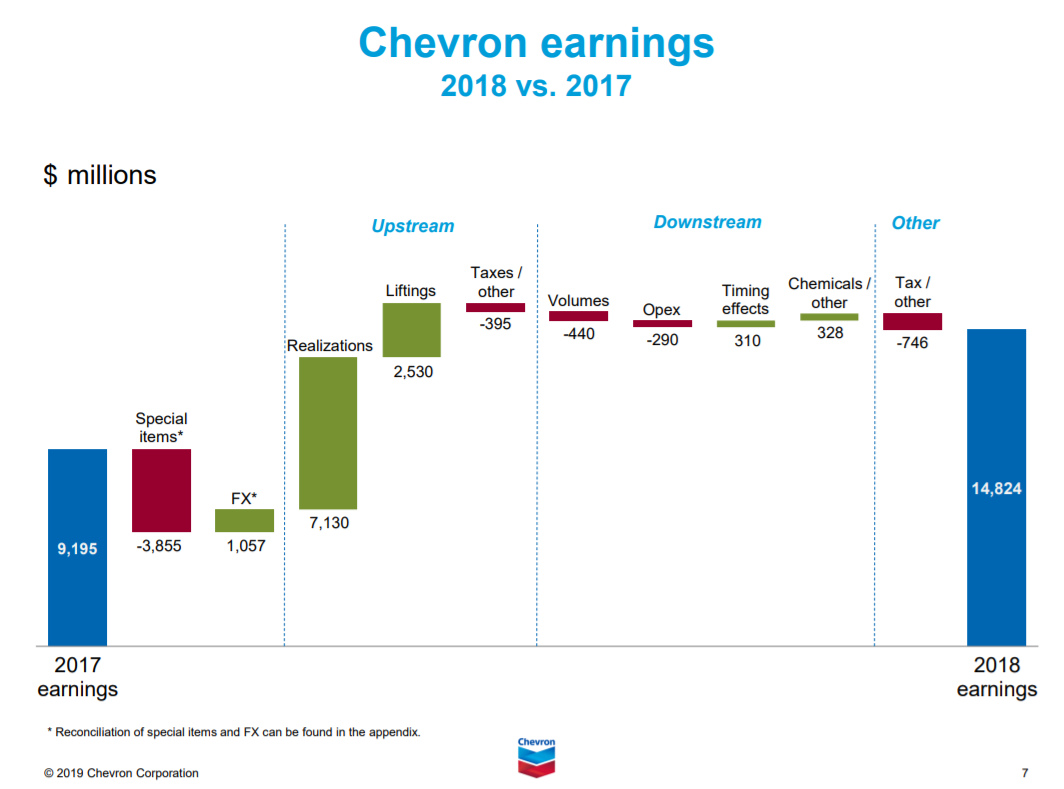

Beat earnings estimates and raised dividends after posting record oil and natural gas production, boosting chief.

Chevron reported total revenue of $48.72 billion, just above analyst estimates compiled by visible alpha of $48.65 billion.